The Science Behind Successful Investing Strategy: Markowitz’s Modern Portfolio Theory Explained

Greetings from ARTIFICALAB LTD! Today, we are excited to introduce you to one of the most influential investment theories that has shaped modern finance: Markowitz’s Modern Portfolio Theory (MPT).

In fact, the theory is developed by Harry Markowitz, who is a renowned economist. He revolutionized the field of finance with his development of Modern Portfolio Theory (MPT) in the 1950s.

His exceptional work introduced the concept of diversification to manage investment risk and optimize returns. As a result, Markowitz’s groundbreaking contributions earned him the Nobel Prize in Economic Sciences in 1990. Up to this day, his theories continue to influence investment strategies and financial practices worldwide.

For investors and financial analysts, understanding MPT can significantly enhance each of their investment strategy. Now, follow with us and let’s dive into the science behind this groundbreaking theory.

INTRODUCTION TO MODERN PORTFOLIO THEORY

The story starts back in 1950s, during which Harry Markowitz revolutionized the world of finance with his Modern Portfolio Theory.

Before his theory was introduced, there are some prevalent investment theories and approaches available in the field of Finance. This includes:

1. Dividend Discount Model (DDM) by John Burr Williams in 1938

2. Value Investing Theory by Benjamin Graham

3. Technical Analysis Techniques by Charles Dow (also known as the Dow Theory)

4. Random Walk Theory by Louis Bachelier

5. Capital Asset Pricing Model (CAPM) by William Sharpe

In fact, these theories and methods laid the groundwork for modern investment strategies and influenced the development of Modern Portfolio Theory. Markowitz’s introduction of diversification and the efficient frontier provided a more comprehensive framework for managing risk and optimizing returns in a portfolio context.

Moreover, Markowitz's Modern Portfolio Theory introduced a systematic approach to investing, emphasizing the importance of diversification to manage risk and optimize returns. As a result, he earned the Nobel Prize in Economic Sciences in 1990, and his principles continue to be a cornerstone of investment strategies today.

"Among all other investment theories and methodologies, Harry Markowitz's Modern Portfolio Theory is my favorite since its methodology is based on the standard deviation (i.e., risk) of the total portfolio rather than relying on each individual asset.

The key idea is that by combining assets that do not perfectly correlate with each other, the overall risk of the portfolio can be reduced.

In other words, you can add more risky assets into your Investment Portfolio while maintaining an acceptable risk for a certain expected amount of return. No other investment theory offer likes this!"

— Mr. Thu Ta Naing, Founder (ARTIFICALAB LTD), MBA (Bangkok University International)

CFA Research Challenge Semi-Finalist 2024 (Thailand)

What are the Core Principles of Modern Portfolio Theory?

This is the key part we teach to our clients & trainees on our Financial Investment courses on Udemy! Understanding the modern portfolio theory is essential since it gives us what optimal % amount of investment assets need to be included in the total portfolio.

Let's explore certain key principles as follows:

The Core Principles of Modern Portfolio Theory

1. Diversification of your investment assets

At the heart of this modern portfolio theory is the concept of diversification. This is actually done by spreading investments across a variety of assets, resulting in reduction of the overall risk of their portfolio. The idea is that different assets will react differently to the same economic event, balancing out potential losses with gains.

2. Understanding Efficient Frontier is crucial to effectively utilize the Modern Portfolio Theory

Markowitz introduced the concept of the Efficient Frontier, a graphical representation of optimal portfolios that offer the highest expected return for a given level of risk. Portfolios on the efficient frontier are considered well-balanced, maximizing returns while minimizing risk.

For details, we will explain that in later section. If you wanna learn more, you can explore our Financial Courses as well on Udemy!

3. You can benefit from the Adjusted Risk and Return of Total Portfolio

Markowitz's Modern Portfolio Theory emphasizes the trade-off between risk and return. Therefore, investors must decide how much risk they are willing to take to achieve their desired returns.

Basically, the theory provides a framework to quantify this relationship, helping investors make informed decisions.

Practically Speaking, where can we apply this Modern Portfolio Theory?

Asset Allocation Process:

To answer this, the first major one is the "Asset Allocation Process" where we, investors, have to decide which investment assets: whether it be traditional assets like stocks, bonds (or) alternative investments like real-estate, commodities, currencies, and cryptos etc., and how much % mix of assets should we invest in?

These questions could be easily solved by this Modern Portfolio Theory. In fact, by balancing different asset classes, investors can create a diversified portfolio that aligns with their risk tolerance and return expectations, in accordance with their investment goals.

Robo-Advisors:

In this AI world, robo-advisors have taken some place due to its ability to create and manage investment portfolios based on the modern portfolio theory's principles.

Investor’s risk profile is automatically analyzed based on user's inputs and recommending a diversified portfolio, making sophisticated investment strategies accessible to everyone.

Other more real-world examples that the Modern Portfolio Theory helped Investors in certain important times!

Here are some real-world examples in which the Modern Portfolio Theory (MPT) is utilized across various asset classes:

1. Tech Stocks

In the last decade, tech stocks like Apple and Amazon have seen significant growth. By including these high-performing but potentially volatile stocks in a diversified portfolio, investors have been able to enjoy substantial returns while mitigating the inherent risks.

Thanks to the Modern Portfolio Theory, it helps a lot in balancing these stocks with other less volatile assets to optimize the risk-return profile.

2. 2008 Financial Crisis

During the 2008 financial crisis, portfolios that were diversified across different asset classes, such as stocks, bonds, and commodities, were less impacted by the market crash. In fact, the Modern Portfolio Theory's emphasis on diversification and the efficient frontier helped investors minimize losses by spreading risk across various investments.

3. Robo-Advisors

As stated above already, popular robo-advisors such as Betterment and Wealthfront utilize the Modern Portfolio Theory principles to create and manage investment portfolios. These platforms analyze an investor’s risk tolerance and financial goals, then recommend a diversified portfolio that aligns with MPT’s guidelines. This approach makes sophisticated investment strategies accessible to a broader audience.

4. Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum are now becoming popular among young investors in their portfolios. Despite their extreme volatility, they typically exhibit low correlations with traditional investments like stocks and bonds.

So, allocating a small percentage of their portfolio to cryptocurrencies would not be a bad choice either. Thus, investors can potentially enhance returns without significantly increasing overall risk, as suggested by the Modern Portfolio Theory.

5. Pension Funds

Up to this current day, the Modern Portfolio Theory is heavily used by the Pension funds, since they have to determine the optimal asset allocation for their clients' portfolios. With diversification across various asset classes such as stocks, bonds, real estate, and commodities, pension funds can now aim to achieve a balance between risk and return that aligns with their long-term financial obligations.

6. Global Diversification is now possible with the help of Modern Portfolio Management

Investors should look forward to diversify their assets globally with the help of Modern Portfolio Theory.

This means allocating assets across different countries and regions. This approach helps in reducing country-specific risks and taking advantage of growth opportunities in various markets.

For example, including emerging market stocks alongside developed market investments can provide a more balanced and diversified portfolio.

These examples illustrate how the principles of Modern Portfolio Theory's diversification and risk-return optimization are applied in real-world investment strategies.

This certainly helps investors achieve their financial goals while managing risk effectively.

A little more details about Efficient Frontier!

Now, before we end this post, let's take a look into the Efficient Frontier as well, which is a key concept of Markowitz's Modern Portfolio Theory!

So, what is the Efficient Frontier ?

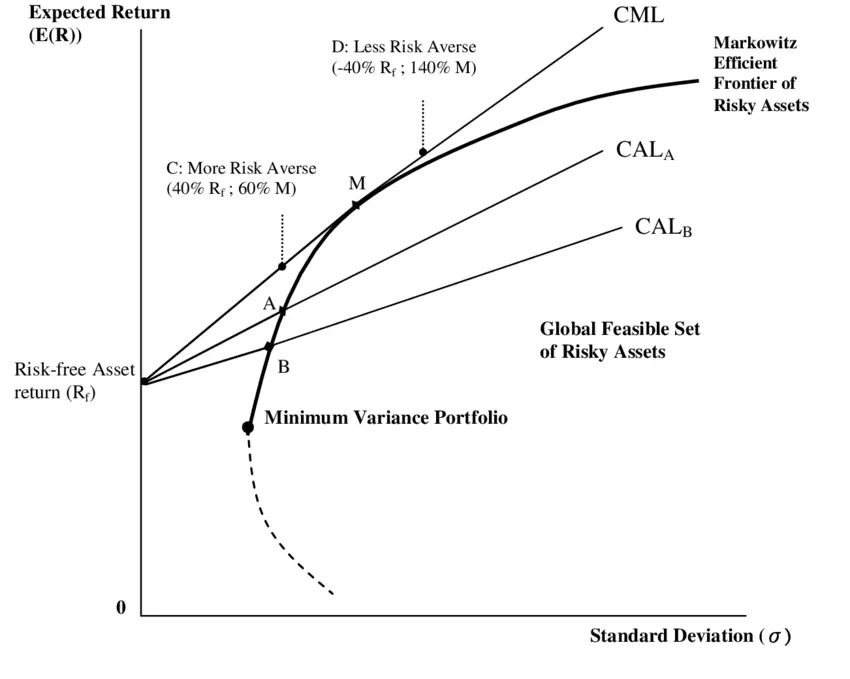

Basically, we can see this as a graphical representation of the set of optimal portfolios that offer

(1) the highest expected return for a given level of risk, or

(2) the lowest risk for a given level of expected return.

In graphical terms, it is often shown as a curve on a graph where the x-axis represents risk (measured by the standard deviation of portfolio returns) and the y-axis represents expected return.

The below image shows a typical Efficient Frontier curve, based on Modern Portfolio Theory.

So, how does this Efficient Frontier relate with Modern Portfolio Theory?

1. Diversification:

Due to the theory's diversification effects, investments can be spread across various assets to reduce risk. By combining assets that do not perfectly correlate with each other, the overall risk of the portfolio can be minimized.

2. Risk-Return Trade-Off:

The Efficient Frontier illustrates the trade-offs between risk and return. Portfolios that lie on the Efficient Frontier are considered optimal because they provide the maximum expected return for a given level of risk. Conversely, for a given expected return, they have the minimum possible risk.

3. Suboptimal Portfolios:

Portfolios that lie below the Efficient Frontier are considered suboptimal because they do not provide enough return for the level of risk taken. Investors should aim to construct portfolios that lie on the Efficient Frontier to maximize their investment efficiency.

However, there are kindly some practical considerations you should consider when applying this Efficient Frontier concept with the Modern Portfolio Theory.

This is because different investors have different risk tolerances. By referencing the Efficient Frontier, investors can now choose investment portfolios that align with their individual risk preferences and investment goals.

By using historical data on asset returns, variances, and covariances, a range of portfolios could be constructed, and the optimal ones are those that lie on the Efficient Frontier.

CONCLUSION

We can't deny that the Modern Portfolio Theory (MPT) has revolutionized the way investors approach portfolio management.

By emphasizing diversification and the optimization of risk and return, the theory provides a robust framework for constructing efficient portfolios. Indeed, it's applications extend beyond traditional investments, influencing areas such as real estate, commodities, and even cryptocurrencies.

As financial markets continue to evolve, the principles of MPT remain a cornerstone for both individual and institutional investors seeking to maximize returns while managing risk. Embracing these strategies can lead to more informed and effective investment decisions in an increasingly complex financial landscape.