Understanding Cash Flow Statements: A Beginner’s Guide

Welcome to ARTIFICALAB LTD! Today, we will share about what are Cash flow statements in the world of Finance, and how these impacts on the financial health of a typical business.

Indeed, navigating the world of finance can be daunting, especially for beginners. However, don't forget that one of the key components to understanding a company’s financial health is the cash flow statement. This guide will walk you through the basics of cash flow statements, their importance, and the implications of negative cash flow.

Three Types of Financial Statements

Now, before diving into cash flow statements, it’s essential to understand the three primary financial statements that companies use to report their financial performance. Let's us explain this briefly:

1. Income Statement:

This statement shows the company’s revenues and expenses over a specific period, providing insight into its profitability. In other words, it is also P&L (Profit and Loss) Statement.

2. Balance Sheet:

This statement provides a snapshot of the company’s assets, liabilities, and shareholders’ equity at a specific point in time. In terms of formula: Assets = Liabilities + Equity, in which the total Assets owned by the company is equal to the sum of the total debt & shareholder's equity

3. Cash Flow Statement:

This statement details the inflows and outflows of cash within the company over a period, highlighting how well the company manages its cash position. In fact, there are 3 types of cash flows which we will discuss soon.

"INVESTORS & FINANCIAL ANALYSTS USE CASH FLOW STATEMENTS TO DISCOVER WHAT THE COMPANY IS CURRENTLY DOING, AS WELL AS THEIR FUTURE POTENTIAL ACTIVITIES AND STRATEGIC INVESTMENTS.

IN FACT, JUST A TYPICAL CASHFLOW IS POSITIVE DOESN'T MEAN THAT THE COMPANY IS PERFORMING WELL. GETTING HUGE DEBT AND SELLING PROPERTY, PLAN & EQUIPMENT CAN GENERATE POSITIVE CASHFLOWS IN A SHORT TERM.

MEANWHILE, A NEGATIVE CASHFLOW DOESN'T MEAN THAT THE COMPANY IS WORSE AT ALL. BUSINESS EXPANSION AND STRATEGIC INVESTMENTS COULD END UP IN A NEGATIVE CASHFLOW IN A SHORT-TERM BUT WILL ACHIEVE HUGE POSITIVE PAYBACKS IN FUTURE! FINANCIAL ANALYSTS STILL NEED TO DISCOVER WHAT ARE THE REAL CAUSES OF CASHFLOWS TO DISCOVER THE SENTIMENT"

— Mr. Thu Ta Naing, Founder (ARTIFICALAB LTD),

CFA Research Challenge Semi-Finalist 2024 (Thailand Local Competition)

Then, What is a Cash Flow Statement?

A cash flow statement is a financial document that tracks the amount of cash and cash equivalents entering and leaving a company. It is divided into three sections:

1. Operating Cashflows: Cash flows related to the core business operations, such as sales and expenses.

2. Investing Cashflows: Cash flows from the purchase and sale of assets, like property and equipment.

3. Financing Cashflows: Cash flows related to borrowing and repaying debt, issuing shares, and paying dividends.

Why is the Cash Flow Statement Important?

The cash flow statement is crucial because it provides a clear picture of a company’s liquidity and solvency. Moreover, it helps stakeholders understand how well the company generates cash to meet its debt obligations and fund its operating expenses. Unlike the income statement, which can include non-cash items, the cash flow statement focuses solely on actual cash transactions.

Consequences of Prolonged Negative Cash Flow

In certain times, there will be situations where the Cashflows of a company will be negative over several years. This can be several reasons, in which financial analysts need to determine the root-cause of negative cashflows before making a conclusion on investment decisions.

Indeed, negative cash flow occurs when a company spends more cash than it generates. While occasional negative cash flow can be manageable, prolonged periods of negative cash flow can lead to serious consequences, such as:

Inability to Pay Bills:

The company may struggle to cover its operating expenses and debt obligations.

Increased Debt:

To cover the shortfall, the company might need to take on more debt, leading to higher interest expenses.

Bankruptcy Risk:

Persistent negative cash flow can ultimately lead to insolvency and bankruptcy.

How Financial Analysts & Investors Assess Firms with Negative Cash Flow

Investors closely monitor a company’s cash flow statements to assess its financial health. Let's say if a company consistently reports negative cash flow, investors may become concerned about its ability to sustain operations and generate future profits. They might:

Re-evaluate Investment:

Investors may reconsider their investment if they believe the company cannot turn around its cash flow situation.

Demand Higher Returns:

To compensate for the increased risk, investors might demand higher returns on their investment.

Monitor Management:

Investors will scrutinize the company’s management to ensure they are taking appropriate steps to improve cash flow.

However, there are some situations where negative cashflows are acceptable during business expansion and strategic investments.

Acceptable Negative Cash Flow During Expansion and Investments

It’s important to note that negative cash flow is not always a red flag or signs of desperation. Mostly, Company's Management and Board of Directors will report that during periods of business expansion or significant investments, companies might experience negative cash flow as they spend on growth initiatives. In such cases, negative cash flow can be acceptable if:

Strategic Investments:

The company is investing in projects that are expected to generate future revenue. For example, opening up new store chains, researching and developing new products & product trends, upgrading internal skills & development of its own human resources etc.

Growth Opportunities:

The negative cash flow is a result of expanding operations, which can lead to increased market share and profitability in the long run. Therefore, for this type of certain cases, instead of concluding as a negative sign, investors should analyze the situation and regard it as a positive indicator for investing, since the company will grow with positive paybacks and cashflow growth in future!

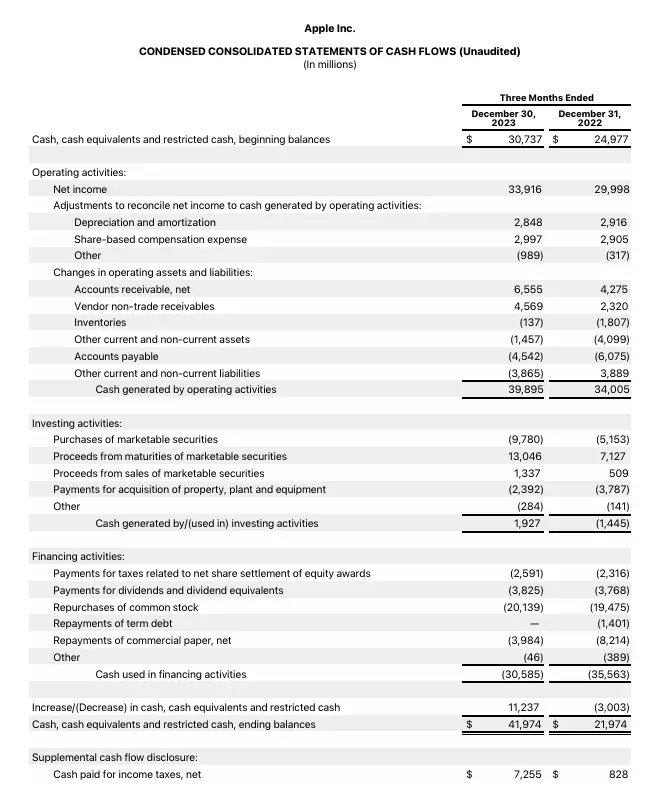

Example of Cashflow Statements

The following image is a sample of Cashflow statements on Apple Inc. Kindly take a look at it and you will see they are divided into 3 sections: Operating Activities, Investing Activities, and Financing Activities.

CONCLUSION

Understanding cash flow statements is essential for anyone looking to grasp a company’s financial health. By analyzing cash inflows and outflows, stakeholders can make informed decisions about the company’s liquidity, solvency, and overall financial stability. While negative cash flow can be concerning, it’s crucial to consider the context and reasons behind it, especially during periods of growth and investment.