From Revenue to Net Income: Mastering the Art of Income Statement Analysis

Greetings from ARTIFICALAB LTD! In this blog post, we will guide you through the components of the Income Statement, since it is one of the most crucial financial documents for any corporation / firms.

In this blog, we will help you to understand the general terms and components of an Income Statement, making it easier for you to read and interpret these statements with confidence. If you would like to explore more, don’t forget to check out our Financial Analysis Courses!

"From my perspective, understanding Income Statement is about understanding the Profit and Loss of the business, respective to its stated yet. However, one thing to keep in mind is that the Income Statement only displays 1 perspective for your Financial Analysis.

In fact, you will need 3 perspectives to approach: Income Statement, Balance Sheet, and Cashflow Statement.

Therefore, you, as a Professional Financial Analyst needs to discover whether the company is actually making cashflows or not!

For that, you might have to explore with other statements: Balance Sheets and Cash Flow Statements!"

— Mr. Thu Ta Naing, CEO & Founder (ARTIFICALAB LTD), Financial Analyst (Self-Employed), CFA Research Challenge 2024 (Semi-Finalist, Thailand)

Then, What is an Income Statement?

We called an Income Statement, in another term, which is also a Profit and Loss Statement.

In fact, it is a financial document that summarizes a company’s revenues, expenses, and profits over a specific period term only.

By analyzing the Income Statement, investors and financial analysts can clearly understand the company’s financial performance, as well as step by step procedures on how the sales revenue is transformed into net income.

Mostly, financial analysts use Income Statements to assess a company’s profitability, operational efficiency, and overall financial health.

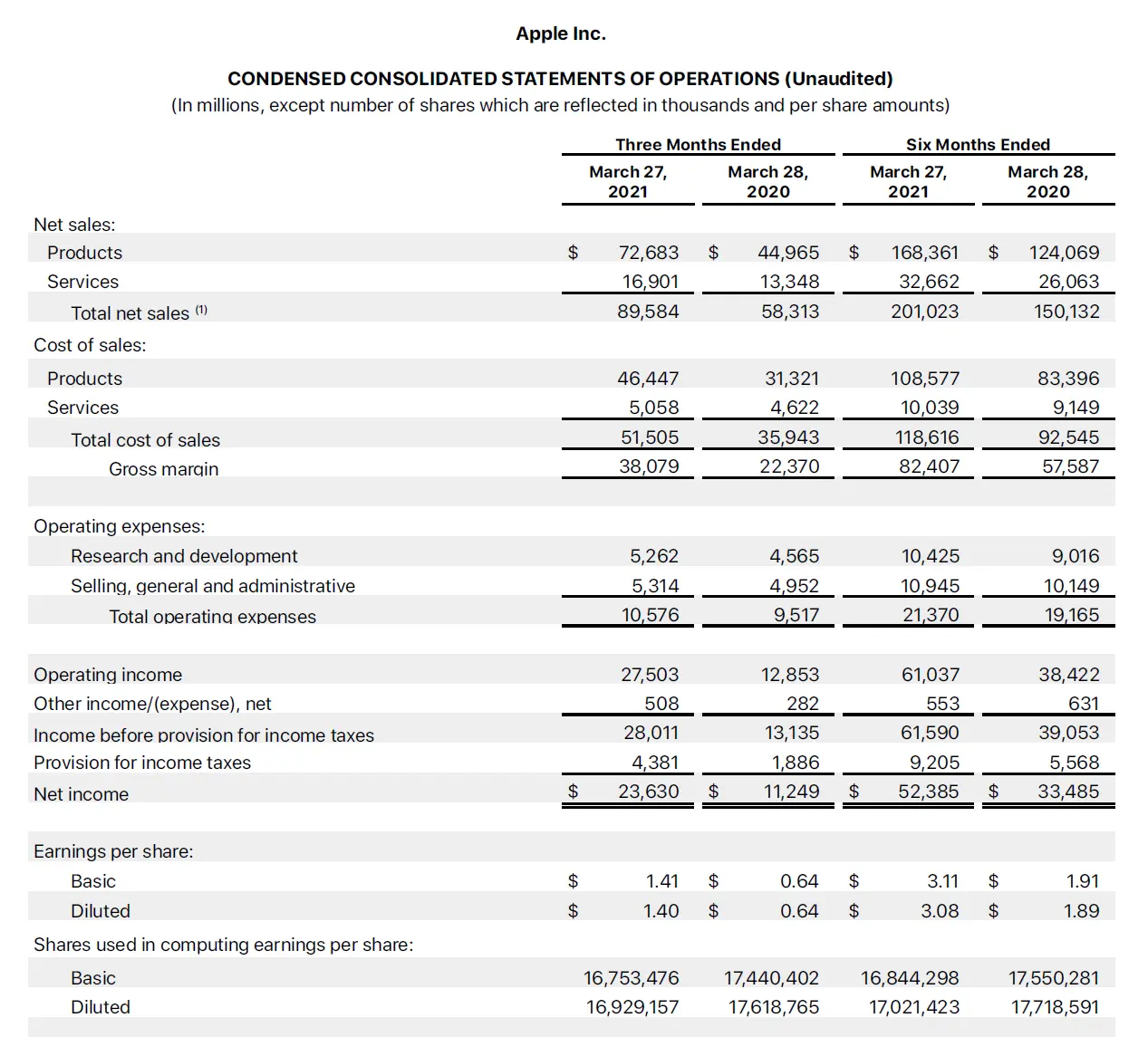

Image courtesy of Apple Inc.

Step by Step: Income Statement Format

The Income Statement typically follows a structured format, moving from revenue to net income. Here’s a step-by-step breakdown of a typical Income Statement as we will shown below:

Revenue (Sales):

This is the total income generated from the sale of goods or services of the typical business before any expenses are deducted. In other words, the numbers in "Revenue" section indicate the pure total sales generated by the company during a specific year term.

For Annual-Report level Income Statements, they are audited while Quarterly-Report Income Statements are often not audited.

Indeed, Financial Analyst can use this Revenue indicator to analyze the revenue stream of current business, while giving an estimate of substantial income would be in future.

For example, in Financial Year 2020, Amazon reported revenue of $386 billion, driven by its e-commerce and cloud computing services. This massive revenue stream highlights Amazon’s dominant market position and its ability to generate substantial income from diverse business segments. For more info, click here.

Cost of Goods Sold (COGS):

Cost of Goods Sold are typically the direct costs related to the goods manufactured by the company. Readers of this blog need to understand that it includes the cost of materials, labor required, as well as the manufacturing overhead related with the production process.

For example, Microsoft’s gross profit in 2020 was $96.9 billion, calculated by subtracting its COGS from its total revenue. This figure indicates the company’s efficiency in managing production costs while generating substantial revenue from its software and cloud services.

Indeed, higher COGS is often not desirable for investors, since it decreases the Gross Profit (i.e. Gross Profit = Revenue - COGS).

Lower Gross Profit often means that the company's operations are not efficient and possibly cannot control its production costs, while Higher Gross Profit means the opposite!

In fact, it can even impacts on the Cash Flow in long term, since more cash is tied up in production costs, decreasing the Working Capital of the company. (However, if you still doesn't understand these terms, don't worry, we will cover up this topics later!)

Gross Profit:

After you have deducted the COGS from Revenue in the Income Statement, we will get the Gross Profit. The formula is Gross Profit = Revenue - COGS.

On Income Statement, it represents the profit a company makes after the costs of production are deducted.

For example, Microsoft’s gross profit in 2020 was $96.9 billion, calculated by subtracting its COGS from its total revenue. This figure indicates the company’s efficiency in managing production costs while generating substantial revenue from its software and cloud services.

Operating Expenses:

Then, we have to deduct the Operating Expenses from Gross Profit. This step is essential since it will reveal the Operating Income (also known as EBIT), in which we will explore below.

For now, those Operating Expenses include all costs required to run the business that are not directly tied to the production of goods or services (e.g., salaries, rent, utilities).

For example, Tesla’s operating expenses include research and development (R&D) costs, administrative expenses, and marketing costs. In 2020, Tesla’s operating expenses were $4.5 billion, reflecting its significant investment in innovation and market expansion.

Now, we'll show you some common ones typically included in the Operating Expenses:

- Salaries and Wages: Payments made to employees for their work.

- Rent: Costs associated with leasing office or factory space.

- Utilities: Expenses for electricity, water, gas, and other utilities.

- Depreciation: The allocation of the cost of tangible assets over their useful lives.

- Marketing and Advertising: Costs incurred to promote products or services.

- Office Supplies: Expenses for items like paper, pens, and other office materials.

- Insurance: Premiums paid for various types of insurance coverage.

- Research and Development (R&D): Costs related to the development of new products or services.

- Travel and Entertainment: Expenses for business travel and client entertainment.

- Legal and Professional Fees: Payments for legal advice, accounting services, and other professional services.

These expenses are essential for the day-to-day operations of a business but are not directly tied to the production of goods or services. They are deducted from Gross Profit to calculate Operating Income (EBIT).

Operating Income (EBIT):

Then, after calculating the Gross Profit in the Income Statement, the next step we need to calculate is the Operating Income.

Please kindly note that the Operating Income is also called the Earnings Before Interest and Taxes (EBIT). This is because the results of Operating Income are the actual Earnings of the company but without deducting Interests and Taxes.

The formula is: Operating Income (EBIT) = Gross Profit - Operating Expenses.

For example, Alphabet’s operating income in 2020 was $41.2 billion, derived from its core advertising business and other ventures like Google Cloud. This figure demonstrates the profitability of its primary operations.

Moreover, for financial analysts, this Operating Income is highly useful for analysis, since higher Operating Income means the company exhibits strong operational efficiency and profitability from its primary business activities while lower Operating Income means the opposite effects.

Also, you as a CFA Financial Analyst needs to understand that EBIT allows for better comparability between companies, since it removes the effects of different capital structures and tax environments.

In other words, financial analysts can compare the operating performance of two companies in the same industry, regardless of their debt levels or tax rates.

Regarding impact on cashflow, we can generally say that higher EBIT (Operating Income) leads to higher cash inflows from operations.

There are still numerous other use-cases with the Operating Income values of the Income Statement. Common Ratios like EBIT Margin, Interest Coverage Ratio, EV/EBIT etc., all uses the Operating Income as a crucial metric in consideration.

So if you become a CFA Financial Analyst one day, don't miss this thing on your Financial Analysis!

Now stay tight, and let's head to the next component of the Income Statement!

Non-Operating Income and Expenses:

We can say that Non-Operating Income and Expenses include revenues and expenses not related to the core business operations (e.g., interest income, gains or losses from investments).

For example, Facebook’s non-operating income includes interest income from its cash reserves. In 2020, Facebook reported $1.8 billion in non-operating income, showcasing its ability to generate additional revenue from investments.

Earnings Before Tax (EBT):

Then, we have to find the Earning Before Tax.

It is calculated as Operating Income (EBIT) plus Non-Operating Income minus Non-Operating Expenses.

For example, Netflix’s EBT in 2020 was $2.8 billion, calculated by adding its operating income to its non-operating income and subtracting non-operating expenses. This figure reflects the company’s profitability before accounting for taxes.

Income Tax Expense (ITE):

Then, we have to list the total amount of taxes owed to the government. In fact, if you don't understand the term "Income Tax Expense", don't worry since it is the financial term, that is used to show the actual taxes need to give to the government for that particular period.

For example, in 2020, Johnson & Johnson reported an income tax expense of $2.7 billion, which is the amount the company owed in taxes based on its earnings.

Net Income:

Finally, we get the Net Income result. You will get this Net Income for that particular period after all expenses, including taxes, have been deducted from total revenue.

Precautions for Financial Analysts on the Income Statement

When analyzing Income Statements, financial analysts must be aware of the differences between IFRS and US GAAP standards. Key considerations include:

Capitalizing vs. Expensing:

IFRS allows for more flexibility in capitalizing development costs, while US GAAP typically requires these costs to be expensed.

Research & Development Costs:

Under IFRS, certain R&D costs can be capitalized if specific criteria are met, whereas US GAAP generally requires these costs to be expensed as incurred.

Common Financial Ratios (from Income Statement)

If you become a Financial Analyst one day, there are certain things you might want to use ratios analysis from the Income Statement. Here, we will show you some of the common financial ratios derived from the Income Statement.

Gross Margin: Gross Profit / Revenue

Operating Margin: Operating Income (EBIT) / Revenue

Net Profit Margin: Net Income / Revenue

These ratios will definitely help you in assessing profitability, operational efficiency, and overall financial health of the target company.

CONCLUSION

For now, we will stop our blog post here. Thank you for reading our ARTIFICALAB blog post on mastering the art of Income Statement analysis. If you liked this post and want to learn more, please go ahead to our Financial Analysis Courses on Udemy!

Happy learning! 😊